Auditing Requirement

The long answer is: Charities that report to the ACNC all have auditing requirements, such as the Annual Information Statement (a document that provides the ACNC with information on your charity, its activities and basic financial information), but only some have reviewing or auditing requirements.

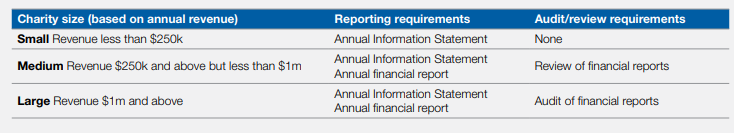

From the 2014 reporting period onwards, medium and large charities have been required to submit financial reports that have either been reviewed or audited. The table below summarises the classifications of charity size, reporting and auditing requirements.

Image: courtesy CPA Australia

As can be seen above, large charities must have their financial report audited, and then must submit both the financial report and auditor’s report to the ACNC. Medium-sized charities must also submit a financial report, but can choose to have it either reviewed or audited unless the charity:

- must have audited financial reports due to other requirements, for example, as directed by the charity’s Governing Documents or a funding agreement; or

- has received a written notice from the ACNC Commissioner stating it must provide audited reports.

Again, medium-sized charities must submit the reviewer’s or auditor’s report to the ACNC, along with the financial report.

- Audits of a financial report must be conducted by one of the following:

- Registered company auditor (RCA);

- A firm with at least one member who is an RCA; or

- An authorised audit company (AAC).

An audit must be conducted in accordance with Australian Standards of Auditing (ASA) issued by the Australian Auditing and Assurance Standards Board (AUASB). In conducting the audit, and preparing the audit report, the auditor must form an opinion as to whether:

- the financial report satisfies the requirements of Division 60 (Reporting) of the ACNC Act; and

- the auditor has been given all information, explanation and assistance necessary to conduct the audit; and

- the charity has kept financial records sufficient to enable a financial report to be prepared and audited; and

- the charity has kept other records as required by Part 3-2 (Record keeping and reporting) of the ACNC Act.

The auditor’s report must describe any material defect or irregularity in the financial report and any deficiency, failure or shortcoming in respect of the above.

The auditor must also sign a written declaration that, to the best of the auditor’s knowledge and belief, there have been no contraventions of any applicable code of professional conduct in relation to the audit or otherwise list out such contraventions in the written declaration.

An auditor’s report must include statements and disclosures required by the ASA and contain a statement from the auditor that it was prepared in accordance with the reporting requirements of the ACNC Act. If the auditor has formed an opinion that the financial report has not been prepared in such accordance, the auditor’s report is required to state why, and the auditor must, to the extent practicable, quantify the effect of non-compliance on the financial report. If the auditor is unable to fully quantify non-compliance, the audit report must state the reasons for not being able to do so.

In having an audit conducted of its financial report, the charity must ensure that the auditor:

- has access at all reasonable times to the books of the registered entity; and

- is given all requested information, explanations or other assistance for the purposes of the audit or review.

A request for information, explanations and other assistance by the auditor must be a reasonable request.

In addition to the above, where a charity proposes to operate or send money overseas, there are further auditing requirements that need to be complied with. Where a charity proposes to operate outside Australia, the ACNC has External Conduct Standards which now apply. These are a set of four standards that govern how charities operating overseas must manage their resources and activities, with the standards being:

- Management of activities and control of resources overseas;

- Annual review of overseas activities and diligent record-keeping;

- Anti-fraud and anti-corruption processed and procedures;

- Protection of vulnerable individuals.

The ACNC may choose to investigate any charity at any time. While not all charities have strict auditing and record-keeping requirements, it is safe to conclude that the best policy is to be diligent in the charity’s record-keeping practices and maintain proper and accurate financial records at all times, so as to ensure that it does not risk any adverse action from the ACNC in this respect. Hence why, even if your charity does not have onerous reporting requirements, the best way forward is to act as if it does.

If you have any questions regarding your charity’s compliance with the ACNC requirements, please contact a member of our charities team.